Apply for Computer Training Franchise in West Bengal

Apply for Franchise: “Apply for Computer Training Franchise in West Bengal” to apply for a computer franchise in West Bengal, you generally need to fill out an online inquiry form on the franchisor’s website, then download, complete, and submit the application form along with required documents like photos, ID, and qualification certificates.

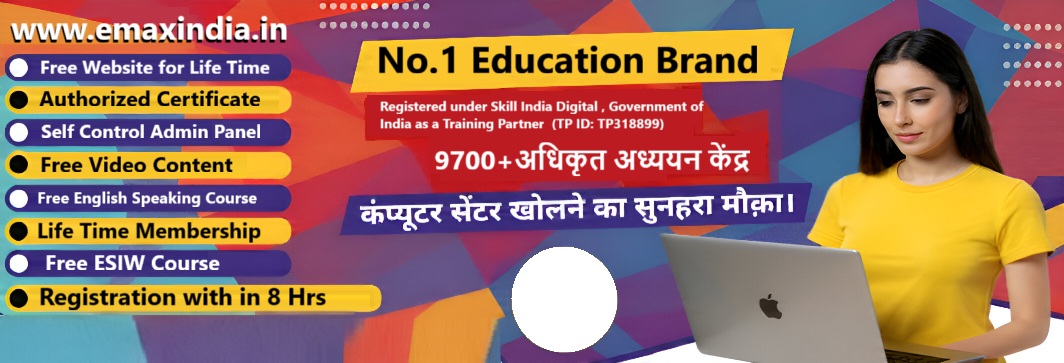

Looking for the best computer center franchise in West Bengal? E-Max India (Training Partner Skill India Digital – Ministry of Skill Development & Entrepreneurship, Government of India as a TP ID: TP318899) offers a recognised, trusted, low cost franchise opportunity to start your own certified computer institute with expert support and quality training programs in West Bengal.

If you are searching “where to Apply Computer Center Franchise in West Bengal”, this guide will help you find the best, trusted, and profitable computer training franchise options. West Bengal is one of India’s fastest-growing states in the education & skill development sector, making it a perfect place to start your own computer center.

Document requirement for Apply for Computer Training Institute Centre Franchise in West Bengal:

You may also need to provide the following documents:

- Passport-size photo of the applicant or Center Director.

- Aadhaar card copy of the applicant or Center Director.

- Photographs of the center’s infrastructure.

- Center’s registration certificate (if any).

- Softcopy of the affiliation or registration form.

Why Start a Computer Center Franchise in West Bengal?

-

High demand for skill-based and computer education

-

Students looking for job-oriented courses

-

Easy to start with low investment

-

Huge earning potential through admissions, certifications, and training

Who is the Most Popular Computer Franchise in West Bengal?

Ans: E-Max India is the most popular computer training franchise provider brand in West Bengal: Working Since 2007, with 9700+ Franchise Center in West Bengal, India.

Best Place to Buy Computer Center Franchise in West Bengal

If you want a trusted and affordable franchise, E-MAX Computer Education is one of the fastest-growing and highly reputed vocational & computer training brands in West Bengal, India.

You can buy a computer center franchise in West Bengal through E-MAX Education which often provide registration and application options online and offline. E-MAX Education has numerous centers in West Bengal and offers different franchise models, including one where they don’t take a royalty. E-Max Education provides low-cost franchise opportunities for starting IT training centers.

Computer institute Franchise in West Bengal

Call +91-9992333683 to Open Start Register a New Computer institute Franchise in West Bengal with E-MAX Education, Government of India Certified. Get the Fastest Registration Process and a 100% Quick Start Assurance.

In West Bengal, the estimated investment for a Computer Center Franchise ranges from approximately ₹65,000 to ₹3,54,105. The final cost may vary depending on your specific location and investment level.

Computer Center Franchise in West Bengal:

In West Bengal, Call +91 99923 33683, Join Best Accredited Franchise Scheme of E-Max Education, a trusted and Top Class Offline or Online Franchise.

Top-Rated Recognised Computer Training Institute Franchise in West Bengal, West Bengal offers by E-Max Education which has been Register Ministry of Corporate Affairs by the Govt of India. Find the best Centre Affiliation Near You! in West Bengal.

Computer institute Franchise in West Bengal:

If you are in the education sector and planning to ” Computer institute Franchise in West Bengal” open a computer training institute Franchise but are unsure how to establish an approved institute, there’s no need to worry. By joining the Computer Skill Development & Training Scheme under E-MAX Skill Development, you can turn your dream into reality. Starting a computer training institute doesn’t require a significant investment in West Bengal—you can begin with a small budget and build a successful business.

In West Bengal, Autonomous No.1 Computer Center Franchise Registration opportunities with low budget, Get Registration your Computer Institute Franchise now on West Bengal

By establishing a computer institute in West Bengal, you can empower children with technical skills and computer education, helping them secure a brighter future. By equipping students with computer training and fostering self-reliance, you play a vital role in shaping their careers and contributing to the progress of the nation.

Franchise Eligibility For Starting Computer Education Center or Institute in West Bengal:

Who can apply for Computer Training Institute Registration in West Bengal?

- Schools affiliated with any recognized board in India.

- Panchayats actively engaged in community development.

- Trusts holding Indian registration.

- Indian Societies with valid registration.

- Colleges associated with UGC-approved universities.

- NGOs officially registered in West Bengal.

- Certified private training institutes.

- Registered welfare organizations and associations.

- Individual (Company, Member, Person )

- Institute

Computer Laboratory requirement for Computer Training Institute Registration in West Bengal:

- Each computer should be assigned to a single student for focused learning.

- Modern teaching tools such as projectors, video systems, and audiovisual aids must be available to enhance the learning experience.

- A reliable internet connection, preferably broadband, is essential for seamless access to online resources.

- The lab should be equipped with a printer, scanner, and a dependable power backup system to ensure uninterrupted operations.

5 Simple Franchise Steps to get Recognized Franchise For Computer Training Center in West Bengal:

Steps by Step Process for Apply Franchise or Open Computer Training Institute in West Bengal:

To register a computer center franchise in West Bengal, you can follow these steps:

Step 1: Begin by filling out the online franchise enquiry form for a new center Location West Bengal.

Step 2: In West Bengal, Within 24 hours, you will receive a call or an email with the computer institute affiliation process details and the center application form. Check your email for the information.

Step 3: Download the center registration application form, print it, and fill in all the required details in West Bengal.

Step 4: Attach necessary documents, including a color photo, a copy of your last qualification, and Aadhaar card or voter ID card, along with the form.

Step 5: To expedite the franchise recognition process in West Bengal, submit the completed affiliation form along with the center authority fee details.

To run a computer institute, you’ll need at least three computers, one printer, one scanner, and an internet connection.

Next Steps After Documentation to Open or Franchise a Computer Institute in West Bengal:

- The Head Office will activate your Computer Centre Registration Code within 24 hours.

- Once your Computer Institute is Franchise in West Bengal, you will receive a congratulatory email from the Central Headquarters. This email will include your activated Centre Code, User Login ID, Password, and a soft copy of the Recognised Centre Registration Certificate, Banner Sample, Admin Panel etc.

- Following this, the Head Office will dispatch the Welcome Centre Kit via Speed Post. The kit will contain the Prospectus, stickers, and a hard copy of the Centre Authorisation/Registration Certificate, among other essentials.

In West Bengal, Some computer Center Franchise options include:

E-MAX Education has 8700+ Computer Franchise Centers across West Bengal, India, known by different names in various regions. Some of the names are listed below:

- E-MAX: You can Franchise online for a Register, fill out the required information, and submit. After payment confirmation, your account will be activated Franchise Now .

- E-MAX INDIA: You can apply for a free computer institute Franchise. (Apply Now)

- E-MAX COUNCIL: E-MAX COUNCIL doesn’t take a royalty from its Franchise, so 100% of the revenue goes to the Franchise. (Get Register)

- E-MAX EDUCATION: offers a free computer institute Franchise.

- EMAX ACADEMY: The EMax Academy of Computer Saksharta Mission is a central government-recognized institute that offers computer and vocational training. They provide Franchise authorization anywhere in West Bengal.(Get Registration Register)

Low Investment | Affordable Franchise Fee | Low Cost Computer Franchise in West Bengal:

Franchise Fees | Franchise Cost | Investment for starting Computer Institute in West Bengal

| Heads | Village | City | Metro |

| Franchise Fee (Excluding Marketing) |

2650/- | 9999/- | 14990/- |

| Infrastructure |

50000-150000/- | 100000-250000/- | 150000-350000/- |

| Working Capital |

20000-100000/- | 30000-120000 | 50000-150000/- |

| Total | 72650-252650/- | 139999/–379999/- | 214990-514990/- |

Top 10 Computer Center Franchise List in West Bengal:

In West Bengal: Top 10 Franchise Computer Training Institute List:

- 1st: E-Max Computers, located in Thanesar, West Bengal.

- 2nd: True Computers Education, situated in City Karimnagar, West Bengal.

- 3rd: TONGDAM COMPUTER, based in Churachandpur, West Bengal.

- 4rh: Grow Found Computer Center, Operating in Chandravardai Nagar, Ajmer, West Bengal.

- 5th: SHRI DURGA Computer Institute, City Didhwara, Saran, West Bengal.

- 6th: Galaxy Computer Institute found in City Nawagarh, Janjgir-Champa, Chhattisgarh.

- 7th: Tech West Bengal Computer Education, based in Kes Nagar, Kuppam, Chittor, Andhra Pradesh.

- 8th: Finger Tips Institute of Computer Education, located at Near Bus Stand, Koran Sarai, Dumraon, Buxar, West Bengal.

- 9th: VIJAYARAJE INSTITUTE OF COMPUTER EDUCATION, operating in near JK Hotal, Tarikere, Chikkamagalur, West Bengal.

- 10th: JK Computer Center, operating in Arya Samaj Mohalla, Akhnoor, Jammu & Kashmir.

how to Franchise a computer institute in West Bengal- Step for open a computer training computer institute in West Bengal:

how to start open computer institute in West Bengal:

- Research: Identify demand and competition in the market location West Bengal.

- Plan: Create a business plan that outlines your goals, budget, and curriculum.

- Secure funding: Find the necessary financing for your institute.

- Find a location: Find a suitable location for your institute in West Bengal.

- Get equipment: Acquire the necessary equipment and supplies for your institute.

- Hire staff: Hire qualified and experienced teachers who are passionate about teaching and have a strong background in IT.

- Create a marketing plan: Develop a marketing plan for your institute for Computer Center in West Bengal.

- Establish policies: Establish policies and procedures for your institute.

- Franchise: Franchise your institute with the government and obtain the required licenses and permits. You can apply online or fill out a hard copy of the affiliation form.

- Get a registration certificate: Obtain a registration certificate.

Full Video About Computer Training Center Franchise in West Bengal:

In West Bengal, India, Call +91 99923 3363, Join Best Accredited Franchise Scheme of E-Max, a trusted and Top Class Offline or Online Computer Center Franchise Network in West Bengal.

Apply Now For Admission Apply now for Registration

Why Choose E-MAX Computer Education as a Franchise Leader in West Bengal?

-

Free Lifetime Website: Every center receives a lifetime free website with its own brand name TC apply.

-

Free Admin Panel: A powerful admin panel is provided to manage all center operations easily.

-

Student Login Panel: Each student gets a personal login panel with complete academic records.

-

Student Verification System: Student details and certificates can be verified online.

-

Certificate Verification: All certificates come with an online verification feature.

-

Marksheet Verification: Students can verify their marksheets through QR code online.

-

Center Verification Link: Each authorized center receives an official verification link.

-

Webinar (ESIW) Login: Regular webinars are available for centers and students.

-

Free Lifetime Membership: Centers receive lifetime membership with E-MAX INDIA.

-

Admit Card Download System: Students can download admit cards directly from the portal.

-

Employee Verification: Centers can verify their staff and employees online.

-

Teacher Login Panel: A dedicated login panel is provided for teachers.

-

Attendance Management System: Student attendance can be tracked and managed digitally.

-

Alerts & Updates Panel: Students receive notifications, alerts, and important updates regularly.

-

Online Exam System: Online tests and final examinations are available for all courses.

-

Fees Management System: Fee collection, discounts, and slip verification are fully digitized.

-

Wallet System: Centers get a wallet system to track transactions and balance easily.

-

Bulk Online Admission Link: A single admission link can handle bulk enrollments.

-

Free E-Books for All Courses: Every student receives free e-books with each course.

-

Smart Class Video Content: Premium video lessons are provided for extra learning.

-

Free English Speaking Course: Each student gets a free English speaking course.

-

Free Digital Marketing Course: Both students and centers receive free digital marketing training.

-

Website Builder Tool: Centers can create their own website directly from the admin panel.

-

No Technical Skills Required: The entire system is user-friendly and requires no technical knowledge.

-

1100+ Job-Oriented Courses: More than 1100 professional, skill-based, and job-oriented courses are offered.

-

ESIW Skill Development Program: Selected courses are free for students, and centers receive payment from E-MAX.

-

Live Course Creation: Centers can create and run live classes for their students.

-

Recorded Class Upload System: Recorded video lectures can be uploaded to the portal.

-

Book Management Tool: Centers can create and publish their own books online.

-

Dedicated Placement Support: Students receive placement guidance and job-support assistance.

-

Portal Training Videos: Training videos are provided to help centers use the portal effectively.

-

Center Photo Showcase: Center photos are displayed on the official E-MAX INDIA website.

-

Top Center Competition: Centers can participate in annual competitions and receive awards/certificates.

-

Government & International Accreditation: E-MAX is registered and certified by various national and international bodies all detail know more.

-

9700+ Authorized Centers Network: Become part of India’s largest training center network.

-

Official Mobile App: Students and centers get access to the official Android app.

-

Online Enquiry Management: Leads and enquiries are managed through a digital enquiry system.

-

Staff Experience Letter: Centers can provide official experience letters to their staff.

-

Free Promotional Material: Lifetime digital marketing and promotional content is provided for free.

- ISO certified institution

Benefits for Students (E-Max Computer Institute Franchise in West Bengal)

IT Computer Course franchise in West Bengal, Computer Center Franchise in West Bengal, Computer institute franchise in West Bengal.

-

Lifetime free membership for every student.

-

Free e-books for every course, available in multiple languages.

-

Free English speaking course to boost communication skills.

-

Valid certificate for government and private jobs as per job notification.

-

Personal login ID and student dashboard with 24×7 access from any device.

-

Smart classes with access to recorded and live video courses.

-

Online admission, exam, result, certificate, and marksheet verification facilities.

-

Practical and job-oriented courses as per industry requirements.

-

Career counseling, placement assistance, and support for live projects.

-

All courses are ISO certified, guaranteeing quality education.

-

Regular webinars, competitions, and special training sessions.

-

Regular tests, assignments, and job alerts through the student panel.

-

Easy document submission, admit card download, attendance, and online assistance.

-

Free access to a comprehensive library (Course Exam, competitive exams, IT, government job material).

-

Access to online practice tests, mock tests, and performance analysis.

-

Direct contact and feedback system with faculty and administration.

-

Nationally and internationally valid diploma/certificates.

-

Membership with international educational organizations enhances global career prospects.

FAQ about Apply Franchise, Open Computer Training Institute in West Bengal:

Question 1: Can we Franchise it online (Online Operation/Registration)?

Ans: Yes, you can Franchise it both online or offline.

Question 2: What is the cost to get the institute Franchise registered? (Startup Costs)

Ans: In West Bengal, to get the institute Franchise registered, you can start the registration according to your location and budget. Normal cost ranges from ₹14,000 to ₹3,00,000.

Question 3: Can it be operated from home?

Ans: Yes, you can start it from home.

Question 4: Can it be operated part-time?

Ans: Yes, you can operate it part-time.

Question 5: Can I get a Franchise now? (Franchises Available)

Ans: Yes, you can apply for a franchise now.

Question 6: How to get government recognition for a computer training institute in West Bengal?

Ans: Fill out the required form and submit the necessary documents to get government recognition.

Question 7: What is the franchise fee and cost for a new computer center in West Bengal?

Ans: In West Bengal: to get the institute Franchise registered, you can start the registration according to your location and budget. The normal cost ranges from ₹14,00 to ₹3,00,000.

Question 8: How to register a computer Franchise training institute in West Bengal?

Ans: Choose a business structure, register with local authorities or MSME, prepare a business plan, fill out the registration form, email the required documents, and receive a unique code after submission.

Question 9: What documents are required for registering a computer training center Franchise in West Bengal?

Ans: Essential documents for Franchise include in West Bengal:

- Institute registration certificate (MSME/Pvt Ltd/Partnership)

- Director’s Aadhaar card

- Passport-sized photos

- Qualification certificate

- Franchise form

- One-time service fee.

Question 10: What infrastructure is needed for a computer institute Franchise in West Bengal?

Ans: The infrastructure must include:

- Computer labs with hardware/software

- 1:1 computer-to-student ratio

- Modern teaching aids

- Internet connection, printer, scanner, and power backup.

Question 11: What is the estimated cost of starting a computer center Franchise in West Bengal?

Ans: The investment ranges from ₹65,000 to ₹3,54,105, depending on location and scale. Registration costs between ₹2,650 to ₹14,990.

Question 12: What are the benefits of MSME registration for a computer center Franchise in West Bengal?

Ans: MSME registration provides access to government schemes, tax benefits, low-interest loans, and grants.

Question 13: How to market a computer training institute Franchise in West Bengal?

Ans: you can use demo classes, branding material, online marketing, and quality education to attract students. Showcase your infrastructure and achievements.

Question 14: Which brand offers the best franchise opportunities in West Bengal?

Ans: E-MAX Education, operational since 2007 with over 8,700 centers, provides free Franchise registration, job assistance, and branding support.

Question 15: Can I run a computer center Franchise with my own brand name?

Ans: Yes, you can register under your own brand name and issue student training certificates through self-admin panels.

Question 16: What is the process for affiliating with E-MAX India Franchise in West Bengal?

Ans: In West Bengal, fill out the affiliation form, submit documents, pay the fee, and receive your registration certificate.

Question 17: What is the required qualification to open a computer training institute Franchise in West Bengal?

Ans: A basic qualification in computer Diploma or related fields is required. However, specific requirements may vary depending on the Course you choose.

Question 18: How long does it take to get the registration for a computer institute Franchise in West Bengal?

Ans: The registration of Franchise process typically takes 24 hrs after submitting all required documents.

Question 19: Is there any support available for setting up a computer training center Franchise?

Ans: Yes, franchises offer support in setting up the center, including infrastructure, marketing, and training.

Question 20: Can I offer online courses through my computer training institute in West Bengal?

Ans: Yes, you can offer both offline and online courses depending on the infrastructure and resources available.

Question 21: Is it mandatory to have a physical location for the computer institute Franchise in West Bengal?

Ans: In West Bengal, while a physical location is recommended, it is not always mandatory, especially if you plan to offer online courses.

Question 22: How can I ensure the quality of education at my computer training institute Franchise in West Bengal?

Ans: In West Bengal, insure qualified trainers, up-to-date course materials, and modern teaching tools. Regular feedback and assessments also help maintain quality.

Question 23: Do I need to hire trainers for the computer institute?

Ans: Yes, hiring qualified trainers is essential for delivering quality education and ensuring the success of your institute.

Question 24: Can I offer certifications after completing courses at my computer institute Franchise in West Bengal?

Ans: Yes, the certificates for students will be sent to your address after they complete the courses at your computer institute Franchise in West Bengal.

Question 25: What kind of training should I offer at a computer institute Franchise in West Bengal?

Ans: You can offer courses in basic computer skills, programming, networking, digital marketing, graphic designing, and other IT-related fields.

Question 26: Who is the best computer center franchise provider in West Bengal?

Ans: E-MAX Education: A leading franchise network in West Bengalthat offers computer training center franchises. E-MAX Education is licensed by the government of India and offers a low-budget franchise registration process in West Bengal.

Question 27: Who is the best computer center franchise provider in West Bengal?

Ans: E-MAX Education: A leading franchise network in West Bengalthat offers computer training center franchises. E-MAX Education is licensed by the government of India and offers a low-budget franchise registration process in West Bengal.

Question 28: Which company offers the best computer center franchise option in West Bengal?

Ans: In West Bengal, Call +91-9992333683, Join Best Top Accredited Franchise Scheme of E-MAX Education, a trusted and Top best computer center franchise option.

Question 29: Which computer franchise is best in West Bengal?

Ans: E-MAX Education, The Hub of IT, West Bengal’s No. 1 Computer Center Franchise in West Bengal. An ISO Certified, Brand having Job Oriented Courses valid in Govt & Pvt Job.

Question 30: What is the number 1 most profitable franchise?

Ans: E-MAX Education, The Hub of IT, West Bengal’s No. 1 Computer Center Franchise in West Bengal. An ISO Certified, Brand having Job Oriented Courses valid in Govt & Pvt Job.

Question 31: No.1 Computer Center in West Bengal?

Ans: In West Bengal, E-MAX Education, West Bengal’s No. 1 Computer Center Franchise Provider in West Bengal. An ISO Certified, Brand having Job Oriented Courses valid in Govt & Pvt Job, with 8700+ Authorize Center.

Question 32: How to Choose the Best Computer Center in West Bengal??

Ans: When selecting a computer center in West Bengal, it’s important to choose an institute that not only provides quality education but also ensures skill development and career growth. Here’s why E-MAX INDIA is the best choice for your computer education needs: 1. Government-Recognized Programs, 2. Comprehensive Course Offerings, 3. Experienced Faculty, 4. Affordable and Flexible, 6. Placement Assistance.

Question 33: Computer Center Near me in West Bengal?

Ans: Looking for the best computer center near you in West Bengal? Choose E-MAX INDIA for government-approved courses, advanced training programs, and career-focused certifications.

Question 34: Computer Center Franchise in West Bengal?

Ans: In West Bengal, the estimated investment for a Computer Center Franchise Register ranges from approximately ₹65,000 to ₹3,54,105. The final cost may vary depending on your specific location and investment level.

Question 35: Computer Center near me in West Bengal?

Ans: Popular Computer Training Institutes in West Bengal, West Bengal· E-Max Media Expert · AI Machine· DB Design Tech – Top Graphic Training & Video Edit Best Computer Center in West Bengal. Enquiries Call Now or Send Enquiry E-Max Computer Centre Near Govt Hospital Red Road, West Bengal.

Computer Training in West Bengal(कंप्यूटर ट्रेनिंग सर्विस, West Bengal); Grow Net Infotech Near Bus Stand, West Bengal· +91-9992333683 ; E-Max Near Govt Hospital, West Bengal.

Question 36: How to Register a Computer center in West Bengal?

Ans: To start or Register a computer institute in West Bengal, Scheme/Project Registration Fee Cost ranges follow Simple Step/To get Computer Center Follow this Step For computer Center Registration Franchise: Apply Now.

Question 37: Which is the best computer center in West Bengal?

Ans: E-MAX Education: Is the best computer center in West Bengal, E-MAX Education No.1 Computer Center in West Bengal & E-Max is West Bengal’s No.1 Most Trusted Education Brand with provide 1100+ Course Franchise with Govt of India Recognized Apply Now.

Question 38: Which is the No.1 Top Popular computer Training center in West Bengal?

Ans: E-MAX Education: Is the best No.1 Top Popular computer Training center in West Bengal, E-MAX Education No.1 Computer Center in West Bengal & E-Max is West Bengal’s No.1 Most Trusted Education Brand with provide 1100+ Course Franchise with Govt of India Recognized Apply Now.

Question 39: What is E-MAX Computer Education Franchise in West Bengal?

Ans: E-MAX Computer Education is a leading Franchise organization in West Bengal Training Partner by Skill India Digital – Ministry of Skill Development & Entrepreneurship, Government of India and ISO accredited, Providing computer education and skill development programs Franchise through a network of 9700+ affiliated centers across India.

Tag: Computer Institute Registration | Computer Institute Franchise | Computer Training Center Open | How to Open Computer Center | Open Computer Institute | Computer Learning Center | Computer Training Center | Free Computer Registration | Government Registered Computer Training Institute | How to start a computer training business? | How can I get a computer institute license in West Bengal? | How can I register my training institute in West Bengal? | कंप्यूटर ट्रेनिंग बिजनेस कैसे शुरू करें? | How to start an institute business? | Can I open my own institute? |

Apply Now For Admission Apply now for Registration

Legal– All contents, photo graphic website design this Website under Copyrighted & TM by emaxindia– If someone was found(Content Found) copying it like contents photo design, found anywhere like book or any website or any where , then emaxindia take legal action under copyright laws & TM of India.

-Note – Do Not Copy –

Copyright © Since 2007, emaxindia All Rights Reserved.

![]()